The Super App in Kazakhstan - Kaspi.kz

Most people probably have no idea where Kazakhstan is. Those who have heard of the country probably heard about it from the comedy film, Borat (2006), which portrayed a very misleading image of the country and is thus very controversial.

While Kazakhstan does not appear on news very often, it has one of the most successful super apps in the world. The super app is Kaspi.kz, developed by Kaspi. Kaspi is a fintech company that operates a marketplace, a bank and a payment network in the country. The company was listed in the London Stock Exchange in October 2020. While investors generally have a perception that companies from Central Asia are usually cyclic companies in mining or oil & gas industries, Kaspi stands out as an interesting technology company in the region.

A Brief History

Vyachesalv Kim, the current chairman of Kaspi, bought a private traditional commercial bank called Kaspiyskiy in 2002. In 2006, Baring Vostok, PE firm, came in and acquired a majority stake in the bank in December 2006. The bank was then renamed Kaspi Bank. Mikhail Lomtadze, a partner at Baring Vostok, was appointed the bank's CEO in 2007.

From Commercial to Retail

The initial plan of Baring Vostok was to exit the investment via either IPO or private sale. The plan did not work out due to the 2007-2008 financial crisis. The change in exit plan led to a change in the business model. Kaspi Bank was initially a commercial bank, lending to corporates and SMEs. It was a competitive industry where Lomtadze considered Kaspi to have no competitive advantage in. Lomtadze dedicated all the bank's resources to retail banking, which he considered a technology game and an area that they could create a competitive advantage.

Rebuilding the Bank

To move into retail banking, Lomtadze and his partners fired the entire management team and rebuilt it from scratch. In the process of rebuilding the talent base, the firm hired many young and tech-savvy graduates instead of people with banking experience. This laid down the foundation of building a technological advantage afterwards.

NPS

It took them 4 years to become a prominent retail bank in Kazakhstan. By 2012, they had issued more than 1 million credit cards, putting them #1 in Kazakstan, since they launched their first mass-market credit card in 2008.

As Kaspi pushed very hard for their position in the retail banking space and profitability, they were very focused on selling their products. All these came with a price: customers hated them. The bank had a poor image and their credit card business, which represented 40% of their revenue, had a negative NPS.

Realizing the fact that Kaspi was hated, they shut down the credit card program in 2012. and shifted their primary focus from profitability to making customers happy (Profitability still matters!).

NPS since then became the KPI of the company. The company has a product head for each of its business lines. They are not benchmarked against profits, revenues or even user growth. The only benchmark for these product heads is the NPS figure. To collect customer feedback and NPS, the company proactively calls their customers to ask about their feedback and one source said the company makes about 50,000 calls a month for the purpose. The company also sources product ideas from customers and tries to solve problems for the customers.

The focus on customers led them to their fist innovation - online bill payment. Before Kaspi, there was a commission on people making bill payments. Kaspi introduced online bill payment in 2012 and removed all commissions. On top of the removal of commission, they also integrated the bill payment with the merchants such that the payment amount can be automatically populated into customers' online banking portal, further removing friction.

Ecosystem

In December 2014, Kaspi launched their own online marketplace along with online consumer finance to provide consumer loans to their marketplace customers. The marketplace scaled up quickly as small merchants quickly adopted to gain access to Kaspi's extensive consumer base.

In July 2017, the company launched its mobile app, Kaspi.kz. It was a great hit because they introduced P2P payment at about the same time. Kaspi customers are able to send and receive money instantly within Kaspi for free (0.95% commission to any third party bank). The P2P payment function created a strong network effect that has been driving strong adoption of the app in the country. The latest MAU of Kaspi.kz is 10M, which is over half of the population in Kazakhstan. It is estimated that out of the 18M population in Kazakhstan, around 10M is economically active. That means pretty much anyone participating in the local economy is a MAU of Kaspi.kz.

Business

Kaspi has been through a lot of changes and it is no longer just a bank today. As of today, there are 3 major business segments in Kaspi:

Fintech/Banking

Payment

Marketplace

Fintech/Banking

The retail banking business has been the core of Kaspi ever since 2008 when they restructured the whole company. About 2/3 of the revenue in this segment is generated from interests on consumer loans and 1/3 coming from fees and commissions.

Source: company presentation

The loan portfolio is more tilted towards short duration consumer loans except car finance, which also has a larger ticker size. Buy Now Pay Later (BNPL) is a very popular loan product due to its convenience. The yield on its loan portfolio has been above 30% due to the high interest rate in Kazakhstan and the higher rate they charge on the consumer loan.

The company has invested heavily in its in-house risk management and credit approval models. Kaspi made use of two types of data for credit approval: one is historic online data, which includes data collected by Kaspi and data purchased from third parties. The second one is consumer activity data on its platform such as whether they are reading reviews or looking at different models with an intent to purchase a product. The results have been great speed, convenience, and lower credit risk. Loan application can be processed in a minute and time to money is 15 minutes, where all can be done on its mobile app.

Payment

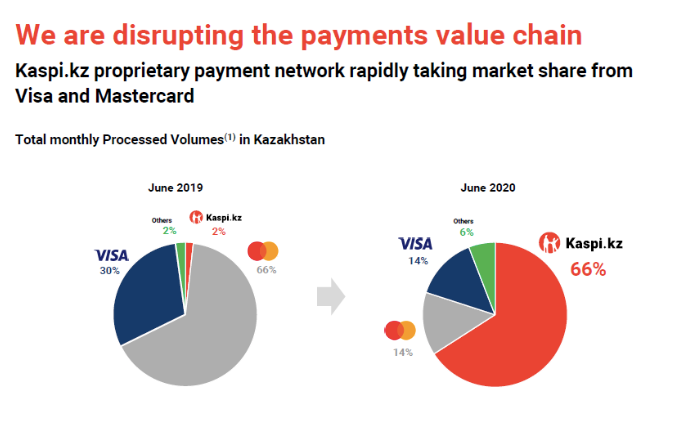

Kaspi's proprietary payment network was launched in mid 2019. It has been disrupting the payment industry with its end-to-end payment functionality that allows consumers paying merchants directly from Kaspi.kz app when the merchants are equipped with Kaspi POS machines, without the needed for a card and third-party payment network such as Visa and Master. Kaspi developed a QR code payment that allows consumers to make payments using the app Kaspi.kz.

Source: company presentation

While Kaspi’s proprietary payment network has only been launched for 2 years, it has grown its market share from 2% in June 2019 to 66% in June 2020 to become the biggest payment network in Kazakhstan. They have been gaining market share by passing back all the savings to the merchants on their POS network.

Marketplace

The idea of building a marketplace came from Lomtadze in 2014. He spent 3 days in 4 stores to buy a new computer. The experience inspired him to start building a marketplace where people can compare prices, select the products they want and then pay, all in the same space.

Kaspi's marketplace was launched in the same year with online consumer finance. The GMV breakdown by product category shows that over 40% of the GMV was in electronics related products such as computers and smartphones. These products are generally regarded as low margin and slow moving products. However, people in Kazakhstan generally prefer financing the purchase of large ticket items on consumer loans. This generates a good demand for Kaspi's fintech business.

Source: Company presentation

Kaspi took an asset light approach to build its logistic network. Their logistic network is built using different third party couriers and logistic partners including airlines with the entire value chain standardized to Kaspi's e-label to allow parcel tracking. Kaspi's role is not moving and delivering the parcels themselves but to manage the logistic network.

Source: Company presentation

They have so far executed this strategy well. They delivered 2.3 million items in 2021Q2, up 205% from 0.7 million items in 2020Q2. 98% of the delivery was free for consumer. 54% was delivered in 2 days.

Source: Company presentation

Management

From the company's history, it is easy to tell that the current CEO Mikhail Lomtadze has been driving a lot of changes and innovation in the company. Lomtadze is regarded as a great leader of the company for his vision. He is described as very reachable, and open and approachable.

I have found anecdotes that he is very focused on product details and customer experience. One source said that, when collecting NPS from customers, he was not interested to just send e-mails to customers, where the response rate is very low. He came up with the idea of making thousands of calls a month to actually talk to customers.

CEO Mikhail Lomtadze (Left), Chairman Vyacheslav Kim (Right)

The chairman Vyachesalv Kim is involved in the business in another way - politics. He spent most of his time in the capital city, Nursultan, to maintain good relationships with the government. Kim once served as an advisor to the prime minister. He explained in 2019 "In emerging markets, everything is relationship-driven."

Kim so far seems to be doing a great job. Kaspi has been in discussions with the president of Kazakhstan on the development of digital economy.1 2Kaspi also launched GovTech in their app in 2020. It allows users to use different government services such as car registry and business registry.

Culture

Based on what I have learned anecdotally, the working culture is often described as 'IT-startup-like', where product development and customer experience are the main focuses. While banks in general are very process-heavy and therefore tend to move slowly, the processes in Kaspi are simplified to reduce the friction internally. Employees are also given more freedom to solve problems and launch new ideas instead of strictly following a handbook.

NPS as Benchmark

The customer focused culture can be shown by the use of NPS as the KPI. It is one of the main KPIs of the whole bank. The company has a product head for each of its business lines. They are not benchmarked against profits, revenues or even user growth. The only benchmark for these product heads is the NPS figure.

The best example of how central NPS is to Kaspi comes from the fate of the credit card business, which Kaspi pulled in 2012. That represented around a third of Kaspi’s revenues at the time. It was found to have a negative NPS and was therefore terminated.

With such a customer-centric culture that is also IT-startup-like, Kaspi's services are often regarded as the best in the country. The product innovation speed is also high. While competitors may be able to catch up on technology such as credit scores, it is much harder to deliver Kaspi's service level.

Competition

On the banking side, Kaspi competes with all major banks in Kazakstan and they are catching up. Other banks have followed Kaspi to launch their own P2P payment service. The major banks in Kazakhstan right now offer such a service, not only for their own customers, but also other banks’ customers. While Kaspi has established its own prominent P2P payment network, the fact that other banks are offering the same service may lead to more competition on new banking customers.

In the eCommerce front, Kaspi mostly compete with AliExpress and local platforms such as Chocolife.me. Some said AliExpress offers very cheap products but the delivery can take weeks while Kaspi is much faster. According to Euromonitor, AliExpress is only the second largest online retailer in the country while Kaspi is the largest one. AliExpress’s GMV growth is also much smaller In 2019, its GMV growth is three times smaller than Kaspi.

Growth Direction

Increasing Penetration

Kazakhstan is still in its early stage of developing its digital economy. The development of fintech, ecommerce and payment are behind countries like Brazil and Russia. There is still quite a long runway for the country as well as Kaspi to further digitalise the economy.

From the company’s IPO prospectus:

The Kazakhstan payments market is still at an early stage of development, as demonstrated by Kazakhstan’s digital payments penetration rate (calculated for Kazakhstan as the percentage of cashless transactions value in the total value of the sum of cashless transactions and total cash withdrawals, adjusted for Kaspi.kz’s P2P figures, and for other countries as the percentage of non-paper payment transactions value in the total consumer payment transactions value), which stood at 31.0% in 2019, compared to 81.6% in China, 76.8% in Turkey, 70.4% in Brazil and 51.4% in Russia in 2019.

Based on Euromonitor estimates, the GMV of Kazakhstan’s online retail market accounted for 3.4% of the total retail sales value in 2019, as compared to 27.0% in China, 7.3% in Brazil, 7.1% in Russia and 5.8% in Turkey.

Kazakhstan’s consumer banking sector is characterised by low penetration of consumer financial services. Consumer Loans in Kazakhstan amounted to 6.7% of the country’s GDP in 2019, as compared to 23.7% in China, 18.1% in Brazil, 8.7% in Turkey and 8.5% in Russia, based on the data of Euromonitor, the IMF and the NBK.

In the latest earning release, Kaspi disclosed that only a third of its users are using all three platforms. This presents a material opportunity for growth in existing users by nudging them into one more Kaspi’s platform.

Geographic Expansion

Kaspi has been trying to grow in Azerbaijan but it is still not material today. Kaspi has also entered in agreement to acquire a payment company in Ukraine. The deal is expected to close in the forth quarter this year.

Azerbaijan has 10 million people and Ukraine has over 40 million. The addition of these two markets can potentially expand the addressable market by a few times. However, it is too early to expect anything material coming from Azerbaijan and Ukraine at this stage.

Vertical Expansion

Kaspi continues to expand its product offerings and further monetise its large customer base in the country. In August 2020, it acquired Santufei, Kazakhstan’s one of the leading online platforms for airline tickets. Kaspi integrated Santufei and later launched Kaspi Travel in its super app. The business breaks even in one year according to the management despite the impact of COVID-19. Going forward, we may see Kaspi launching more new products and services in its super app to further keep the users in the app. This approach may even be better than geographic expansion as Kaspi has already collected a lot of data on customers in Kazakhstan and can leverage on the use of its P2P payment service, which is a high frequency service.

Risks

Small Market

Kazakhstan has a population of around 18 million even though it is a large country. Kaspi.kz has 10.2 million MAU according to the 2021 Q2 figure. We can see that the growth from adding new users in Kazakhstan is limited by the 18 million total population. This means Kaspi will need to pursue growth via geographic and vertical expansion, in which they may face more competition

Politics and Regulations

"In emerging markets, everything is relationship-driven." - Vyachesalv Kim, Chairman of Kaspi

Relationships are unpredictable and we will never know whether Kaspi’s good relationship with the government will go on.

Kaspi has been building everything in its closed system and has been expanding in different areas. Kaspi is eating incumbents’ lunch. These incumbents also have their own relationships with the government. If one day they lobby hard enough that the government pass a new law to force all P2P payment to be free across different banks, what is going to happen to Kaspi?

Right now the risk does not seem high because Kaspi is regarded as a partner of by the Kazakstan government in the development of the country’s digital economy. There are also government utilities (GovTech) built in Kaspi.kz. From this perspective, the risk is not that high but it is always worth keeping eye on this front, especially when regulating tech companies is a global trend now.

Potential Politically Exposed Insider

Forbes has a great report on this and I recommend you to read it. Kairat Satybaldy, the nephew of Kazakhstan’s former longtime president Nursultan Nazarbayev, used to be a shareholder of the company. He sold his shares to Kim in 2018 to exit. The shares were then ‘transferred’ to Lomtadze. While Kaspi claimed that Satybaldy is no longer involved in the company, it is hard to verify it. Satybaldy is regarded as one of the most influential people on politics and economy in the country.

Some may view it as a positive for Kaspi to have such a ‘history’ with one of the most powerful men in the country because it may help with the frictions from regulations. One should also be careful with the uncertainty involved and the share transfer between Kim and Lomtadze, raises a concern on corporate governance.

Currency Risk

Kazakhstan is an economy that is heavy correlated with commodity prices such as metals, oil and gas. Its economy and currency Kazakhstan Tenge (KZT) are heavily influenced by macro economy and commodity prices. KZT is never a major currency and historically has been quite volatile. The currency had major devaluations in 2013 and 2015. The exchange rate is only stable in recently two years. Almost of the income of Kaspi is generated in KZT. If there is another major devaluation, the earnings, reported in USD, and the stock will go down massively for sure.

Credit Risk

While most of the loans are short duration consumer loans and Kaspi has close monitoring on its credit risk models, its loan book still carry credit risk. In an economic downturn, consumers may have more difficulties paying back their debts and this will increase Kaspi’s NPL. Note that an economic downturn can hit BOTH the currency and credit. That will be a double punch on Kaspi’s financial performance.

Valuation

Below is how I model the company’s growth in the next two years. The growth rates in 2021 are from management’s guidance for the year and they are on track of meeting it.

The highlighted figures are my guesses. I assumed quite bit of declaration in the future growth rates. Multiple contraction on the payment and marketplace segments is also modelled as growth decelerates.

While I may be using multiples that are too high, we can easily say that the company is probably valued in the lower end compared to its peers in other markets. If Kaspi is able to deliver a fair amount of growth in the next few years, I may find its multiple today too low with hindsight a few years later.

Note: The above valuation is calculated at the price of USD115 with an exchange rate of USD to KZT at 426.

Final Thoughts

On the business side, Kaspi probably checks most of the boxes. However, it is not without concerns, particularly on the political side. While the valuation is low compared to most e-commerce/payment/fintech companies except Alibaba, I believe it is harder to underwrite a long investment horizon such as 5+ years.

With all these being said, the company is growing quickly while trading at a very reasonable multiple. It seems to have a good chance to continue delivering good results in the next 2 to 3 years given the strong execution and dominance in the country.

Disclaimer

This article is only for informational purpose and should not be relied upon as investment decisions. Investors should conduct their own research before conducting any transaction.

I am long Kaspi and may sell its shares at any time.